On choosing a niche

A Digiday article talks about the story of Mic.com. It started in 2012 and across its lifetime has raised ~ $60 million. From 2012 until 2019, it has pivoted multiple times, each time struggling to find a moat.

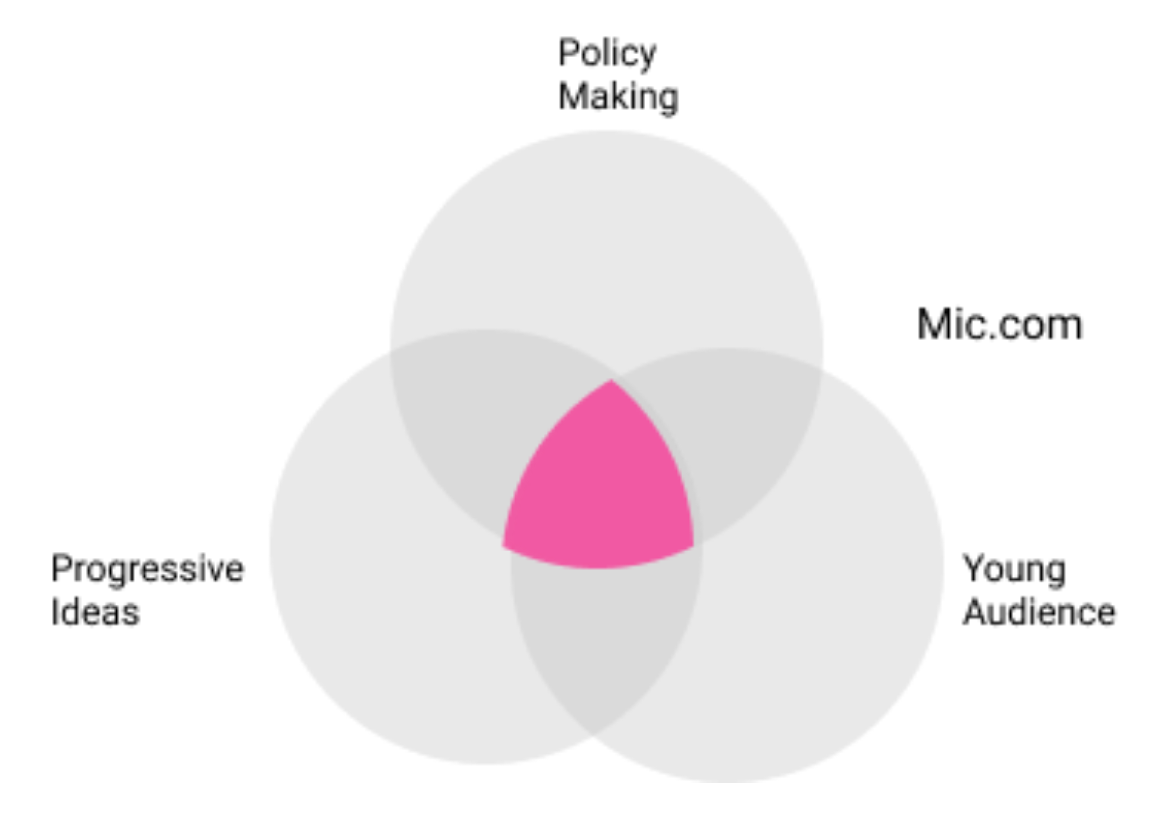

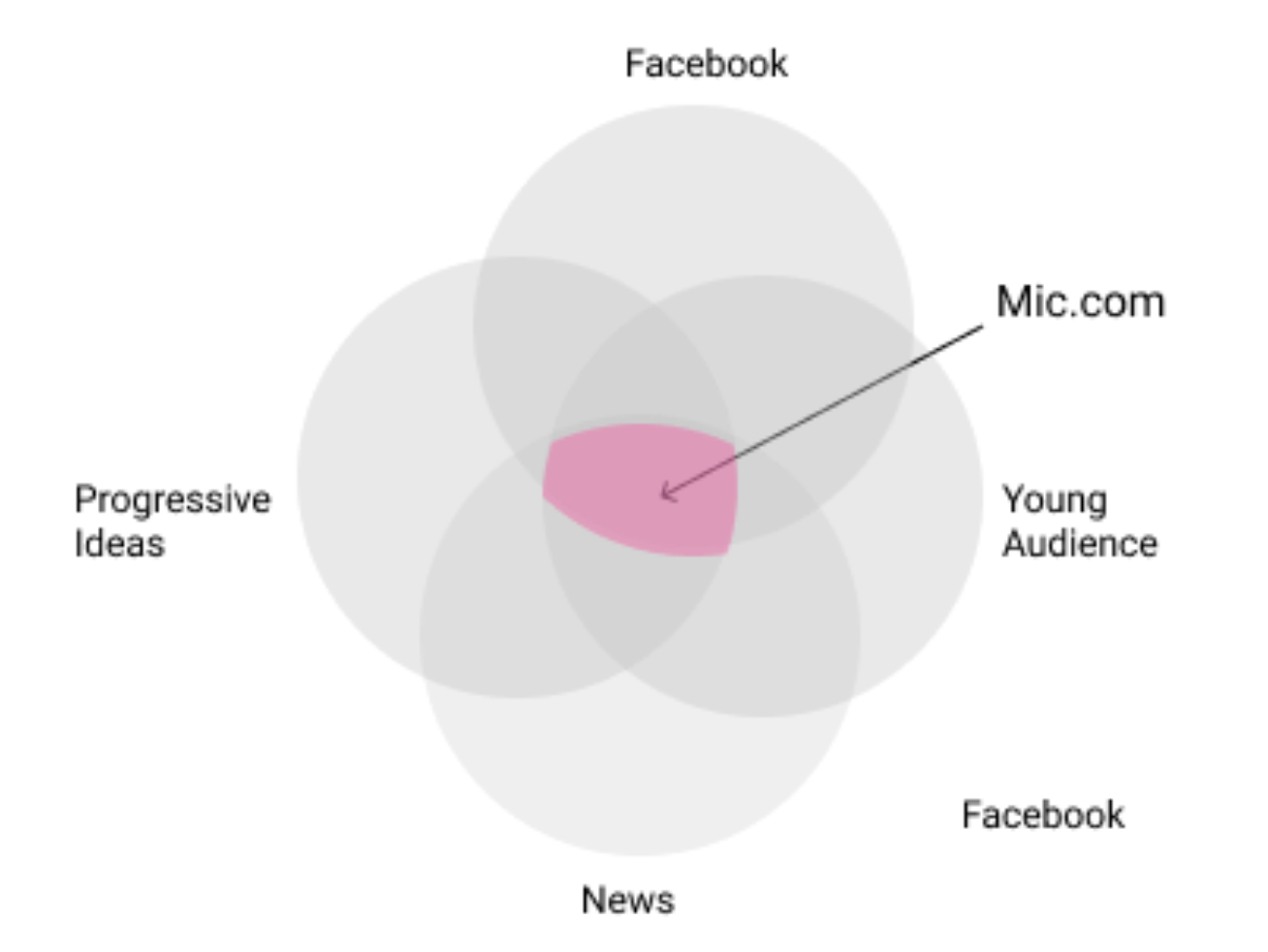

Each of its pivots was an attempt to find a new niche news product at a unique intersection.

Let’s say there is a market out there for people interested in progressive ideas. A subset of that audience will be interested in policymaking. An even smaller subset of that would be young. This narrow niche news product was Mic.com’s first product in 2012.

In 2014, they decided to pivot. This time, Mic.com dropped policy and started covering news, and doubled down on Facebook. But, unfortunately, that was an even narrower market.

In 2016, they dropped Facebook and started focusing on traffic from SEO. In 2017, they dropped articles and started focusing on videos. In 2018, they made one last pivot towards trying to become a content agency.

Eventually, in November 2018, Mic.com laid off the majority of its staff.

What are niches

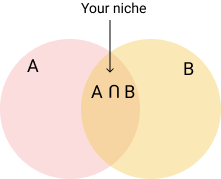

The idea of intersection comes from set theory in mathematics. Set theory is a branch of mathematical logic that studies sets, which informally are collections of things.

Let’s take an example. There are two sets, A being young people and B being the people who like listening to Pink Floyd. Then the intersection of A and B (represented mathematically as A∩B) is young people who enjoy listening to Pink Floyd.

A niche media product is hyper-targeted to the needs of a particular industry, product category, or other groups of customers with specific needs. Thus, it offers an experience tailored to a particular group of users’ unique needs.

Often startups or new initiatives build unique niches around the following factors: Topic, Political Ideology, Channel, Format, and Prism. For example, NewsDeeply sat at the intersection of single-issue and deep reporting. It covered issues such as the war in Syria, global malnutrition, the health of oceans, the global migration crisis, the water crisis in the US, the economic advancement of women in the developing world, etc.

Yes, there are advantages to launching niches

Prior to the Internet, a writer, journalist, teacher, musician, or performer was restricted by time, energy, and geography. For a niche interest to be viable, there had enough of a following (interest) within a 10-20 km range. The Internet changed all this. Now, you can now reach, connect with and interact with others who are interested in the same obsession.

Yes, a novel new niche is a great way to start a company or launch a product.

Novelty makes it easy to find a landing spot in a crowded market. Unfortunately, when businesses define extremely narrow niches, they dominate that niche by default initially.

But eventually, they struggle.

Broadly, there are only two possibilities.

One possibility is that the niche is often so narrow that there isn’t a viable business. What is ignored is that the competitors of left-leaning-ideology x opinions publication aren’t other left-leaning-ideology x opinions publications but the universal set of all news sites. All news sites, in turn, compete with all media and entertainment. Netflix famously said that their primary competitor isn’t other production houses but sleep.

The second possibility is that if the niche turns out to be lucrative, then competitors will follow. You cannot stop them from copying you.

Ben Smith, in his column in the New York Times, says, “And The Times has swallowed so much of what was once called new media that the paper could read as an uneasy competition of dueling traditions: The Style section is a more polished Gawker, while the opinion pages reflect the best and worst of The Atlantic’s provocations. The magazine publishes bold arguments about race and American history, and the campaign coverage channels Politico’s scoopy aggression. “

How to choose a niche for a media product

A new small business is like a child. It needs a safe space to play, experiment, survive, and grow. A niche provides you that. Hence, it is wise to a startup in a niche and then scale from there.

Yes, choosing a topic of deep interest is the most organic and serendipitous way to start. You are actively following the topic for yourself. Might, as well, take the extra step to make it public and find more people interested in the topic.

What if you are interested in more than one topic? Alternatively, what if you want to discover a new niche. Finding a niche is a combinatorial problem which means there are infinite possibilities.

In this post, we discuss how to evaluate niche ideas in a structured way. Just like with photography, finding a niche takes constant zooming in and out, finding the right focal point, etc., to get it right. There is no correct answer. Hence, you need to move between step 1 and step 2.

Step 1: Find a niche to own

Below are a few methods to find a niche.

1.1 Focus on a specific beat or industry

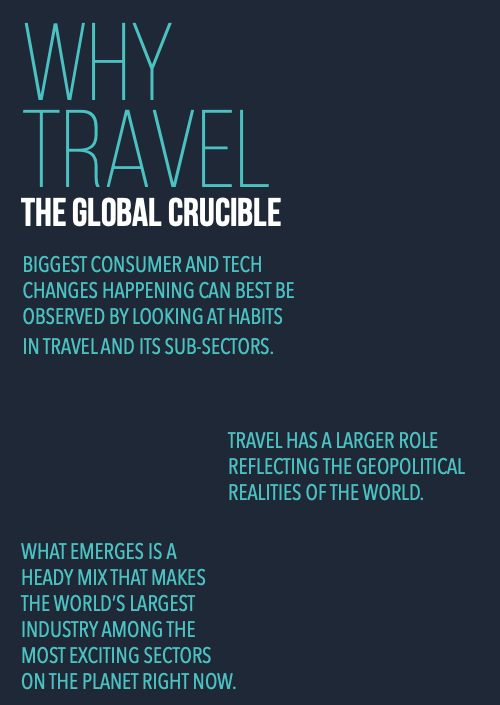

Rafat Ali, the founder of Skift.com, says, “Look for an industry where there is much growth, change, flux, and opportunity. Also, look for an industry with sufficient spending capacity.”

In the image, Rafat explains why he started a media product to cover the travel industry.

1.2 Vantage point of X

Are you deeply interested in a crowded subject area? Then, provide a new lens to look at that subject. E.g., cover government policy, budget, and decisions from the lens of impact on women’s everyday lives. Of course, it won’t be a neutral coverage of that issue. Still, it will deeply resonate with your target audience.

1.3 Democratize tough to access niches

Find a topic that is scarce/expensive to access at scale and make it available. Few examples come to mind. Paper.vc and Zaubacorp make accessing the Ministry of Corporate Affair’s company database easy. People’s Archive of Rural India gives a view of rural India to urban Indian and international audiences.

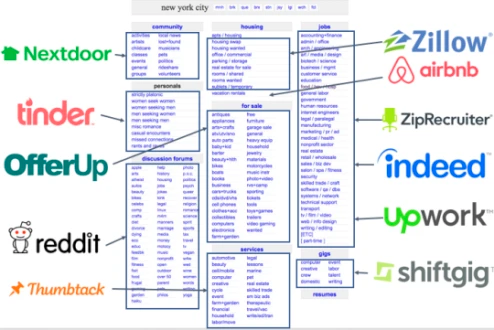

1.4 Unbundle a mega-corp

What can you unbundle out of a catch-all media platform and do better than them?

For further reading, check out this article on AZ16. https://a16z.com/2019/09/11/platforms-verticals-unbundling/

1.5 Bring structure to an otherwise fragmented market

The Internet rewards clear and structured products, especially in fragmented markets that are low in trust. Two non-media examples that come to mind are RedBus and Housing.com, which brought structure to otherwise low-trust markets.

Step 2: Evaluate if the niche makes sense

If all of the following rejection criteria are not met, then discard the niche candidate.

- Avoid competition. The idea of building niches is to be so unique that there is no other competition. Pick a distinct slice of the economic pie.

- Is enough of a population interested in the topic? Can this niche be scaled to include ~10,000 or at least ~1000 paying subscribers?

- Is this something that society does not know how to get by itself at scale? New businesses should serve nonconsumers — people who find the existing alternatives so expensive or inconvenient that they would prefer not to consume them. Targeting nonconsumers ensures that you get the time to grow in that niche without worry about competition.

Of the niche candidates that remain, carefully evaluate the niche candidates basis the selection criteria.

“The winners in these markets either offer the broadest breadth or the deepest depth. In evolving markets, neither the broadest nor deepest is in trouble, but the middle market is withering.”Marc Andreessen, months before AZ16’s investment in Buzzfeed

- Is the topic deep enough to attract experts or enthusiasts who want to dig deeper?

- Is the topic broad enough for year-on-year consistent daily coverage? If the topic is too wide, it will be tough to collect an audience.

- Is it multi-dimensional in nature? Will the topic crop up in conversations across the board?

- Does the topic require tracking across an extended timeframe? If yes, the site can build a longitudinal outlook towards the topic.

- Is there an existing community online or offline that is already talking about this topic? Can you co-opt them? It is challenging to build an audience out of individual interest areas.

- What industry are you betting on? Does that industry have a ready set of funders/brands you can rely on for revenue? E.g., Rafat choose the travel industry to bet on because it has big-ticket purchases, extremely high turnover, international scale.